Share

The New Rules of China-US Competition

Welcome to the Audere Atlas, the Audere Group’s fortnightly update on global geopolitical trends, how we engage with them, and what they mean for your organisation.

This week we examine the deepening strategic contest between the United States and China – how rivalry across trade, technology and security is reshaping the global regulatory environment, redrawing supply chains, and redefining corporate risk.

The Audere Atlas offers timely, actionable insights that both support key decision-making and highlight areas for further exploration and understanding.

The Bottom Line

The Trump-Xi meeting in Seoul delivered a tactical truce, not a structural reset. US-China competition has crossed a threshold: trade, tech and security frictions are now hard-wiring regulatory and supply-chain bifurcation. Companies will need materially stronger due diligence and supply-chain intelligence to stay compliant, resilient and competitive.

The Brief

The US–China relationship remains a structural contest spanning trade, technology and security. The Trump–Xi meeting at APEC in South Korea yielded a narrow détente: Washington and Beijing agreed to suspend select tariffs and export controls for one year, reopen agricultural trade, and cooperate on fentanyl enforcement. The limited easing calmed markets and halted an escalating tariff spiral, but the terms were carefully time-bound and reversible – underscoring that tactical compromise now coexists with strategic confrontation.

Follow-on notices in early November confirmed the temporary suspension of most additional tariffs on agricultural and industrial goods, the removal of a small number of US firms from Chinese control lists, and Beijing’s commitment to resume large-scale soybean and grain purchases. These moves – paired with reciprocal pauses on US restrictions – mark the first real cooling of trade tensions since Trump’s return to office. Yet officials on both sides have stressed implementation “in accordance with national security needs,” leaving open the option to reimpose measures at any time.

Even as trade measures ease, technological competition is intensifying. Beijing has instructed state-funded data centres to phase out foreign chips in favour of domestic processors, offering subsidies to offset higher energy costs. The directive signals that China’s push for self-reliance will override efficiency concerns, embedding decoupling into critical infrastructure. It mirrors Washington’s own push for sovereign semiconductor production and highlights a global shift towards “national tech” as a security priority.

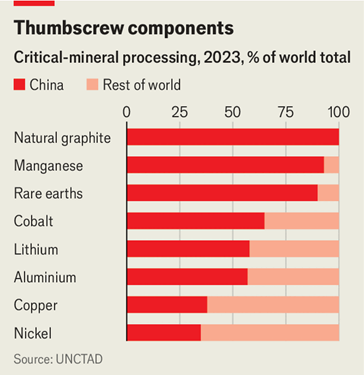

The balance of leverage remains uneven. The US still dominates in advanced semiconductor tooling and design software, while China controls most rare-earth refining and midstream manufacturing. The APEC reprieve buys time but not stability; each side now possesses the legal and regulatory tools to reapply pressure with little warning. Treasury officials suggest China’s leverage on rare earths may fade within two years as allied supply projects expand, but for now mutual dependency continues to define the competitive equilibrium.

Security dynamics further entrench this divide. Persistent flashpoints in the Taiwan Strait and South China Sea, combined with Trump’s renewed defence partnerships in Japan and South Korea, keep escalation risks high. His post-APEC remark that “Taiwan never even came up” reassured markets but unsettled regional allies, reinforcing a strategy of calculated ambiguity.

Policy hedges are emerging but will take years to mature. US-allied projects in Australia, Canada and India to diversify mineral and battery supply chains remain at early stages. The APEC pause offers a breathing space for businesses, but not an escape from bifurcation: compliance, licensing and dual-track sourcing will remain core features of the operating environment.

[Source: The Economist]

So What?

US-China competition now demands that companies treat compliance as both bilateral and extraterritorial. The APEC truce offers a temporary reprieve but not a reversal. The deeper structure of US–China competition remains intact: two economic systems running in parallel but increasingly governed by incompatible rules. The suspension of tariffs and export controls has eased immediate pressure, yet it has also highlighted how volatile the compliance environment has become. Regulatory boundaries now move with political cycles and strategic intent, making it harder for firms to interpret where lawful business ends and geopolitical risk begins.

In this setting, due diligence is no longer a procedural exercise but a strategic function. It is how companies identify exposure to fast-shifting regulation, opaque ownership, and informal influence networks that are not visible in financial statements. What once meant verifying a counterparty’s legal existence now means understanding its role within an ecosystem of affiliates, investors, and political patrons. The capacity to anticipate enforcement rather than simply respond to it is emerging as a differentiator between resilient and vulnerable firms.

China presents a particular challenge. Corporate filings are often incomplete, registry data inconsistent, and beneficial ownership concealed through layered holding structures and regional shell companies. Public information can be restricted by new data-protection rules, while requests for operational or ownership detail are increasingly viewed as politically sensitive. Even basic due-diligence tasks—verifying a subsidiary’s shareholders, tracing board connections, or confirming export licences—may require cross-referencing regional records, informal sources, or on-the-ground enquiries. The risk of misinformation is compounded by the growing use of local proxies and state-affiliated investors whose interests are not disclosed.

These conditions make traditional compliance frameworks inadequate. Static questionnaires or database checks cannot keep pace with regulatory volatility or the discretionary way in which new controls are enforced. Instead, companies need dynamic due-diligence systems that blend open-source research, financial forensics, and discreet human intelligence to build a live picture of exposure. The goal is to move from compliance as documentation to compliance as foresight – knowing when a rule is likely to change, and where vulnerabilities sit within a value chain before a licence is revoked or an entity is blacklisted.

The technological dimension of competition only reinforces this imperative. Beijing’s ban on foreign chips in state-funded data centres and its subsidies for domestic processors illustrate how rapidly market access can shift for political reasons. When regulatory lines can be redrawn overnight, the ability to trace who ultimately controls a supplier, and where its components originate, becomes essential to continuity of operations.

For multinationals straddling both systems, this is now the frontier of risk management. Enhanced due diligence provides the evidentiary backbone for securing export-control exemptions, validating sourcing claims, or defending against allegations of circumvention. It also supplies the intelligence to segment business lines, ring-fence sensitive subsidiaries, and design internal audit trails that demonstrate “reasonable assurance” to regulators in multiple jurisdictions. Firms that invest in these capabilities can continue operating when others must pause to investigate their own exposure.

Audere Group can underpin this shift from static compliance to dynamic risk management. Enhanced Due Diligence combines HUMINT and OSINT to resolve beneficial ownership, identify shadow affiliates, map political exposure and sanctions risk, and assess source-of-funds and reputational vulnerabilities. Supply-chain investigations and monitoring trace provenance of rare-earth content, battery materials and specialised components, validate supplier integrity where documentary trails are thin and track licence status changes and enforcement trends.

Market-entry diligence and monitoring add regulatory horizon scanning across US/EU/PRC regimes, partner vetting and policy-risk updates that feed sourcing and customer segmentation. Sanctions and regulations checks align screening to tightened US ownership capture and China’s licensing demands, building practical red-flag systems for re-export and end-use. Geopolitical analysis and strategic advisory provide scenario planning around conflict flashpoints, election-cycle volatility and supplier substitution playbooks for boards. Where mislabelling, trans-shipment or forged certificates of origin are suspected, Audere can deploy discreet fieldwork and covert enquiries to validate factory operations and end-user declarations.

The operative assumption should be that policy pauses are temporary, treating Washington’s expanded ownership capture and Beijing’s licensing regime as possibly durable features of the corporate landscape. Competitive advantage will accrue to firms that invest early in deep, investigative due diligence and live supply-chain intelligence—building the documentation, optionality and audit-readiness to keep operating when the rules change, and change again, overnight.

Keen to Know More?

The Audere Group is an intelligence and risk advisory firm offering integrated solutions to companies in complex situations.

We specialise in mitigating the financial, reputational and physical risks faced by our clients in markets across the world through a 360-degree range of services incorporating security advisory, crisis management and strategic intelligence to inform decision making around transactions, supply chains and disputes.

Contact us to learn how our bespoke risk advisory services can work with your unique circumstances to navigate high-risk environments and changing landscapes through the provision of hard-to-reach intelligence and clear analysis.

Disclaimer: The content of this report is for informational purposes only and does not constitute legal or financial advice. For further details or specific inquiries, please reach out to our team directly.