Share

Congo’s Blood Minerals

Welcome to the Audere Atlas, the Audere Group’s fortnightly update on global geopolitical trends, how we engage with them, and what they mean for your organisation.

This week, we discus the escalating crisis in eastern DRC. M23 rebels, backed by Rwanda are expanding their control over key mining regions, threatening a humanitarian crisis and regional instability. With sanctions targeting Rwanda’s involvement and growing scrutiny over illicit mineral flows, the conflict’s second and third-order effects risk jeopardising global critical mineral supply chains.

The Audere Atlas offers timely, actionable insights that both support key decision-making and highlight areas for further exploration and understanding.

The Bottom Line

M23’s continued expansion in eastern DRC, with Rwandan backing, threatens regional stability and disrupts global supply chains reliant on Congolese minerals. Companies sourcing from the region already face severe compliance and reputational issues, and risks will only increase as international pressure mounts.

The Brief

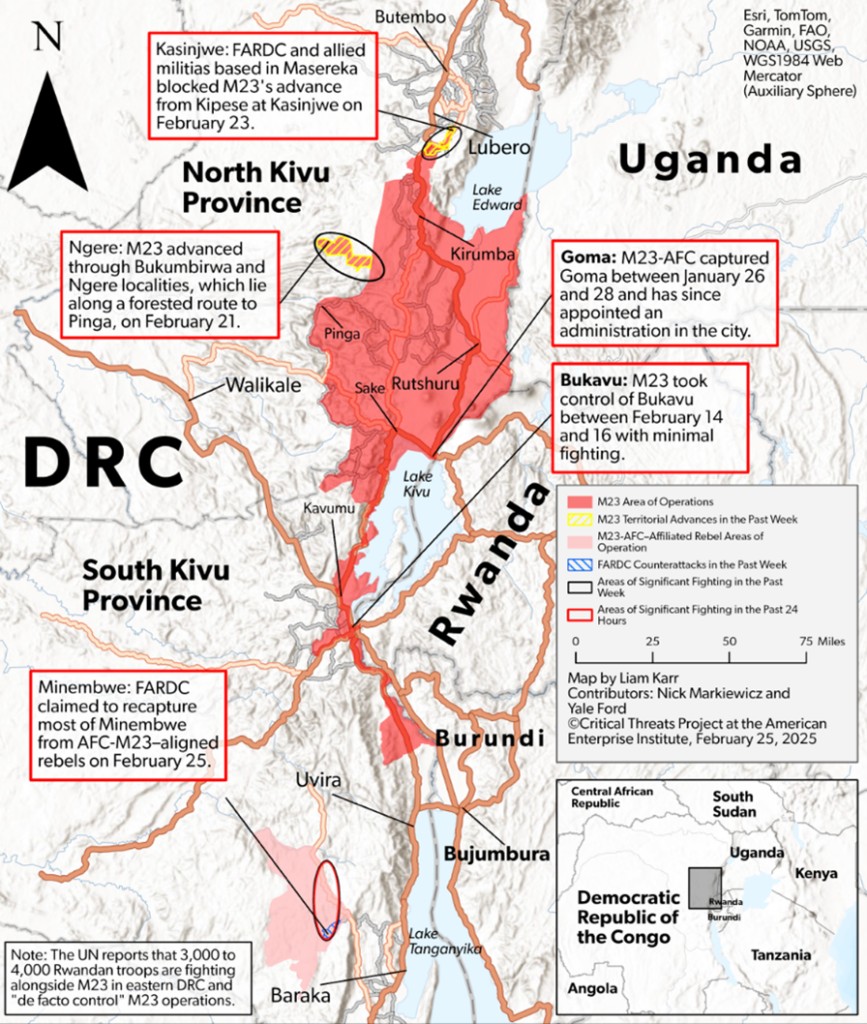

Eastern Congo remains in turmoil as the M23 rebels, backed by Rwanda, continue their territorial expansion, capturing strategic locations and threatening regional stability. In January 2024, M23 seized Goma, a key commercial hub, followed by the capture of Bukavu in February. The group has since expanded its control, securing vital mining areas, including Rubaya, a significant site for coltan extraction (see map 1).

This offensive, the most significant in over a decade, jeopardises global supply chains that rely on Congolese minerals. The UN reports that between April and December 2024, M23 generated nearly $800 million from illicit taxation on mineral exports. The capture of Bukavu and control over Lake Kivuhave given M23 further economic leverage, allowing it to regulate trade routes and tax local commerce. Additionally, the group’s control over the Kavumu and Goma airports has restricted access, exacerbating the already dire humanitarian crisis.

M23 enjoys substantial Rwandan military and logistical support. UN estimates indicate that 3,000 to 4,000 Rwandan troops are currently embedded with M23, providing direct assistance. Rwanda denies involvement, but intelligence reports highlight Kigali’s role in smuggling key resources such as cobalt, tantalum, and gold, which are essential for the global tech and renewable energy industries.

International actors have responded with mounting pressure on Rwanda. The US, UK and EU have imposed sanctions against Rwanda, with the UK suspending bilateral aid (excluding humanitarian aid) and defence training assistance to Kigali. European lawmakers have proposed a freeze on EU aid to Rwanda and a reassessment of trade relations with Kigali. Germany, Belgium, and the UK are also reconsidering their diplomatic engagement with Rwanda in response to the crisis.

Meanwhile, the EU is under growing pressure to suspend its controversial 2024 minerals agreement with Rwanda. The agreement, which grants the EU access to Rwanda’s mineral supply, has been criticised for in directly fuelling the conflict. A coalition of 64 organisations, including human rights groups from the DRC, has urged the EU to cancel the deal, citing Rwanda’s alleged role in mineral smuggling.

Despite a ceasefire agreement signed on February 8, 2025, M23continues to advance. President Félix Tshisekedi, facing significant domestic opposition, is unlikely to recognise M23’s territorial gains, making a near-term resolution improbable. M23’s continued advances towards Uvira and Kamituga raise the risk of regional escalation, with Burundi increasingly vulnerable to spillover violence. The retreat of Burundian troops and South Kivu’s deteriorating security could draw in regional forces, further complicating the conflict. Precedent suggests Rwanda is unlikely to withdraw support unless faced with significant economic consequences, increasing the likelihood of prolonged instability in eastern DRC.

Map 1: M23 Advances in Eastern DRC, 01 January – 25 February 2024. Source/Critical Threats

So What?

Instability in eastern DRC extends far beyond the conflict zone, directly disrupting global supply chains. The DRC supplies over 70% of the world’s cobalt and other key materials for EV batteries and high-tech industries, and rebel-controlled mining operations, especially in North and South Kivu, are deeply intertwined with artisanal extraction and smuggling networks. Companies sourcing minerals from the region, particularly in the tech, renewable energy, and automotive sectors, have already seen their supply chains jeopardised by conflict, and will now experience further disruption.

This is playing out in real time. The DRC has filed complaints in Belgium and France, alleging that Apple knowingly sourced minerals extracted by armed groups in eastern Congo. A Belgian investigative judge is overseeing the case, which claims Apple’s supply chain includes illegally sourced tantalum, tin, tungsten, and gold (3TG minerals), contributing to conflict, child labour, and environmental degradation.

Apple strongly denies the allegations, stating that it adheres to strict sourcing policies and has found no evidence of suppliers financing armed groups. However, the complaint also questions the effectiveness of mineral certification processes, arguing that minerals labelled as Rwandan are often smuggled from Congo. A UN report found that Rwanda-backed rebels fraudulently exported at least 150 metric tons of coltan to Rwanda in 2023, supporting claims that Congo loses $1 billion annually to smuggling. As a result, Apple has instructed suppliers to halt sourcing 3TG metals from DRC and Rwanda—a move that critics see as an implicit admission of weaknesses in Apple’s supply chain.

The consequences will not be limited to Apple. This legal battle exposes vulnerabilities in corporate due diligence frameworks and challenges the credibility of existing certification schemes. Beyond legal compliance, these developments signal a broader shift incorporate risk management. Sanctions, trade restrictions, and regulatory changes could lead to further supply shortages and force companies to rethink sourcing strategies. Investors, ESG-conscious consumers, and regulators will demand greater transparency, pushing firms to adopt stricter due diligence and traceability measures. Businesses that fail to anticipate these risks could face reputational damage, compliance failures, and operational disruptions.

Supply chain disruptions, price volatility, and a heightened risk of sanctions exposure are not hypothetical risks; they could force businesses reliant on Congolese minerals to seek alternative sources. Those sourcing from Rwanda already face additional compliance risks amid mounting evidence of illicit mineral flows and associated sanctions. Second-order effects of these sanctions could see corporate partnerships impacted more broadly in East Africa, compounding the uncertainty over regional investment strategies.

This is a turning point. The Apple case is a clear warning that regulatory scrutiny is intensifying, and supply chains once considered secure are now vulnerable. For companies with exposure to the region, proactive risk mitigation is essential. Audere International helps businesses navigate these challenges by providing supply chain intelligence, regulatory risk assessments, and enhanced due diligence. Our expertise ensures clients make informed investment decisions, avoid sanctions exposure, and protect operations in an increasingly volatile landscape.

Keen to know more?

The Audere Group is an intelligence and risk advisory firm offering integrated solutions to companies in complex situations.

We specialise in mitigating the financial, reputational and physical risks faced by our clients in markets across the world through a 360-degree range of services incorporating security advisory, crisis management and strategic intelligence to inform decision making around transactions, supply chains and disputes.

Contact us to learn how our bespoke risk advisory services can work with your unique circumstances to navigate high-risk environments and changing landscapes through the provision of hard-to-reach intelligence and clear analysis.

Disclaimer: The content of this report is for informational purposes only and does not constitute legal or financial advice. For further details or specific inquiries, please reach out to our team directly.