Share

Critical Minerals and the New Resource Geopolitics

Welcome to the Audere Atlas, the Audere Group’s fortnightly update on global geopolitical trends, how we engage with them, and what they mean for your organisation.

This week, we discuss how critical minerals have become the fault lines of a new geopolitical contest—from the Congo to the Pacific seabed. Trump’s resource push is driving US diplomatic engagement and inviting geoeconomic retaliation from China, setting the stage for a far more competitive scramble for the materials that power modern life.

The Audere Atlas offers timely, actionable insights that both support key decision-making and highlight areas for further exploration and understanding.

Critical Minerals

The Bottom Line

Critical minerals underpin both the global energy transition and the rearmament of the West. The return of Donald Trump to the White House has supercharged US efforts to reduce dependence on China by reshaping domestic and international mineral supply chains. While this creates opportunities for new partnerships, particularly in Africa, the fragmented nature of Western policy and the dominance of Chinese processing capacity mean that strategic vulnerabilities remain.

The Brief

The strategic anxiety surrounding access to critical raw materials is not new. During the First World War, the United States drew up a list of “War Minerals” to manage supply disruptions in tin, platinum, nitrates, and potash. A century later, the list of such materials has multiplied in line with technological innovation. The shift from a dozen metals to close to the full periodic table reflects how embedded these minerals have become in everything from EV batteries to fibre optics and aerospace components. The International Energy Agency (IEA) projects a six fold increase in demand for critical energy transition minerals by 2050. Their combined market value already rivals that of iron ore, reaching over $325 billion in 2023 alone.

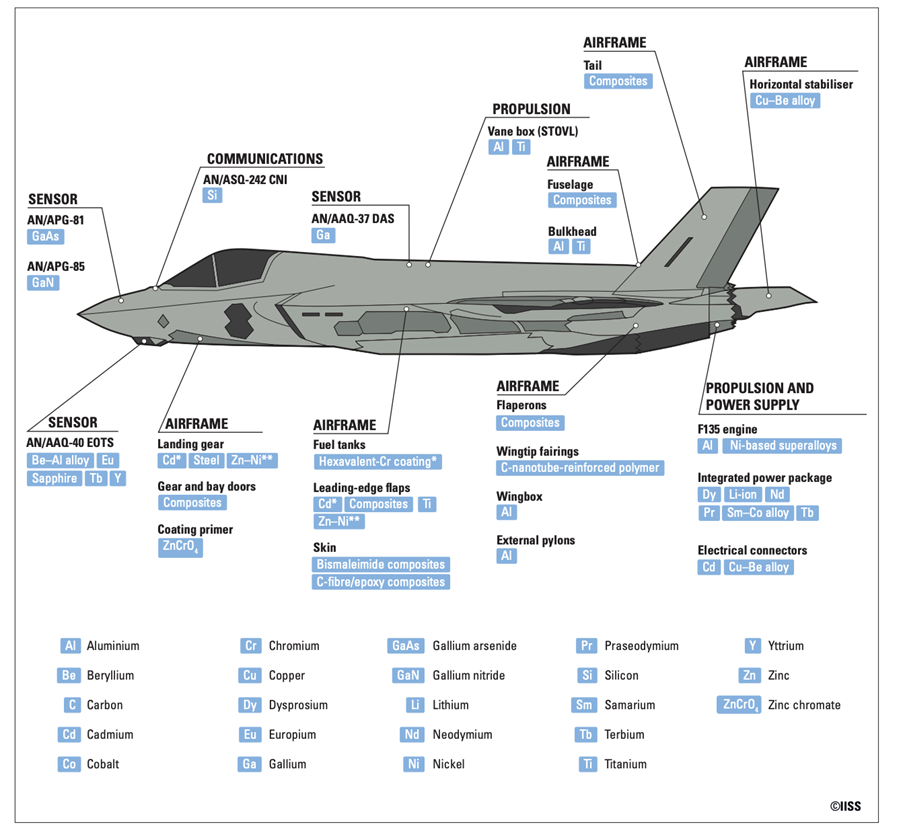

In addition to their importance for the clean energy transition—powering solar panels, EV batteries, and wind turbines—these minerals are indispensable to Western defence modernisation efforts. Gallium, tungsten, and cobalt, for instance, are integral to radar systems, guided missiles, and jet engines. The International Institute for Strategic Studies (IISS) highlights that these minerals are increasingly dual-use: vital to both climate goals and hard power.

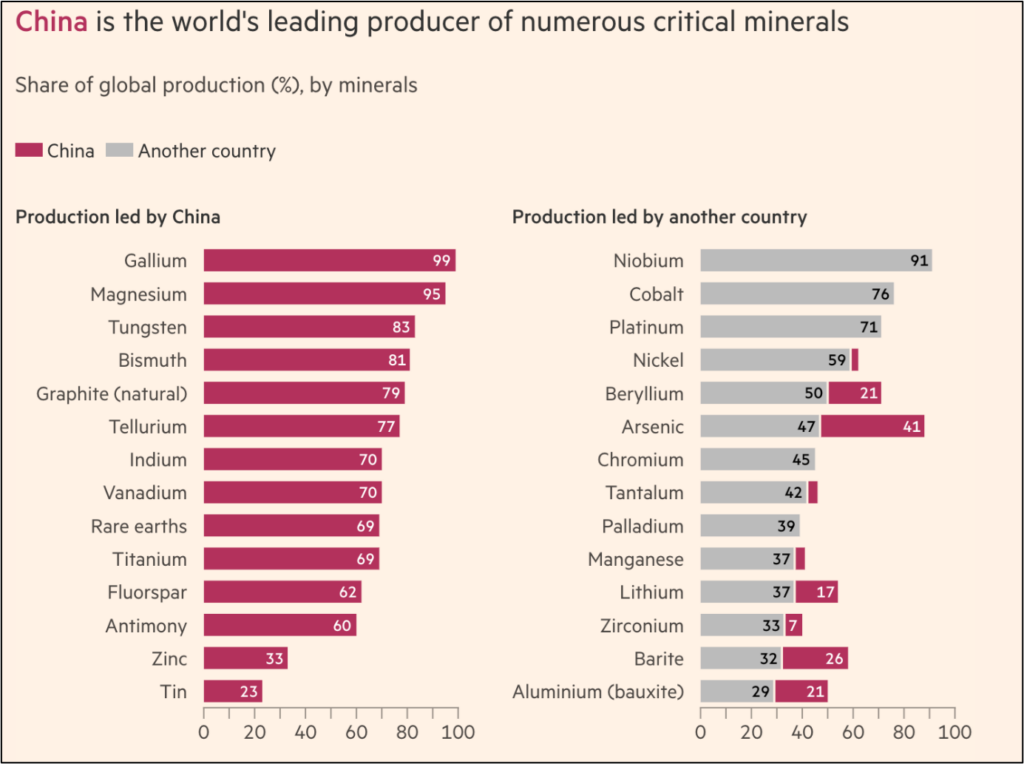

The problem, however, lies in their supply concentration. China dominates the refining and processing of many of these materials, such as graphite and rare earths, and has not hesitated to deploy export controls as a geopolitical lever. Western states, in contrast, have historically outsourced both extraction and processing, driven by cost efficiencies and environmental concerns, but are now grappling with the strategic risks of that dependence.

Image 1: Components and materials used in an advanced fighter aircraft (Source/IISS)

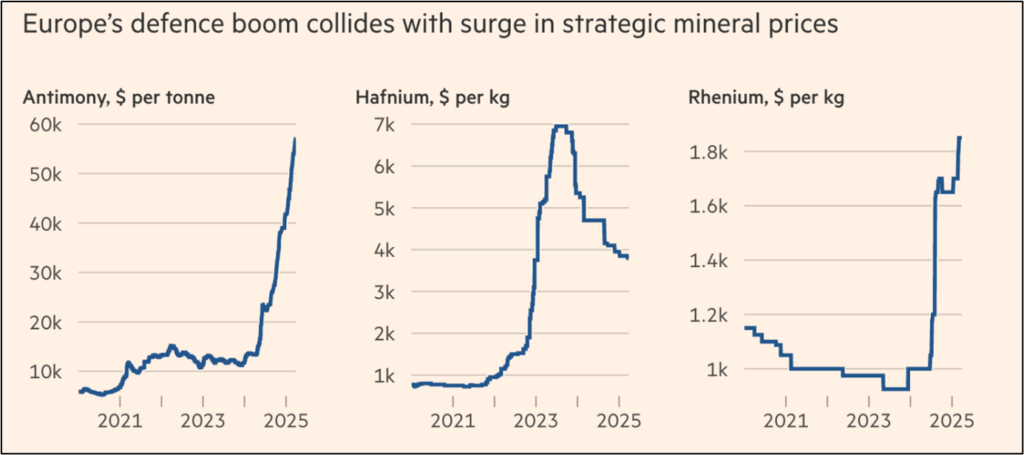

Image 2: Europe’s defence boom and metals prices (Source/FT)

Acceleration under Trump

Since returning to office in January 2025, President Trump has placed critical minerals at the heart of his national security and industrial policy agenda. On14 February, he signed an Executive Order establishing the National Energy Dominance Council, tasked with coordinating federal efforts to increase domestic energy and critical mineral production and streamline permitting and regulation. On 20 March, he signed an Executive Order under the Defense Production Act aimed at immediately expanding domestic mineral production in uranium, copper and lithium. This was followed in April by the launch of a Section 232 investigation into national security risks posed by critical mineral supply chains, a move which could pave the way for new tariffs or procurement restrictions. These measures form part of a wider effort to reduce reliance on Chinese inputs and build out a resilient, American-led supply chain for key technologies.

This effort has extended into America’s diplomatic agenda. In Africa, Trump’s administration has made a clear pivot from aid to trade, with a focus on securing access to essential minerals. The Democratic Republic of the Congo (DRC), home to four of the world’s five largest cobalt mines, has emerged as a key partner. According to a March 2025 report by the Center for Strategic and International Studies (CSIS), the DRC attracted more mineral exploration investment in 2024 than any other African country—$130.7 million—edging out even Indonesia and Kazakhstan.

Trump’s White House has also played a mediating role in mining-related disputes in the region, underscoring a new assertiveness in resource diplomacy. Elsewhere, the US has signed a minerals cooperation agreement with Ukraine and sought new supply routes through the Middle East, where Saudi Arabia is being courted as an alternative source of key transition metals. In Latin America, the US is leveraging free trade agreements with countries like Chile, Colombia, and Peruto facilitate access to these resources, while also investing in infrastructure and processing capabilities to reduce dependence on Chinese supply chains. Domestically, mining projects in Texas and Nevada are being fast-tracked under new permitting rules.

In perhaps the most controversial move, the Trump administration has also authorised a push into deep-sea mining, is suing an Executive Order in April to explore offshore extraction as a long-term solution to supply constraints. While the sector is still in its infancy and carries substantial environmental risks, it signals Washington’s determination to diversify its sources—over land or sea.

So What?

Despite the flurry of executive actions and diplomatic overtures, the United States remains deeply reliant on Chinese processing capacity and new mining sources. Even with aggressive investment in domestic mining and recycling, the IEA estimates that new supply will only reduce the need for virgin mineral extraction by 25–40% by mid-century. Recycling and substitution efforts will help, but cannot wholly offset the concentration of upstream and midstream control currently enjoyed by China. Beijing has continued to acquire overseas assets at pace, spending $10 billion on overseas mines in the first half of 2023 alone, with a particular focus on lithium, cobalt, and nickel.

Image 3: Chinese metal and mineral dominance (Source/US Geological Survey, via FT)

Europe faces a similar dilemma. The continent has only recently awakened to its raw material dependencies, particularly in defence applications. In 2024, the EU introduced the Critical Raw Materials Act, flagging that lithium demand is expected to increase twelvefold by 2030 and cobalt demand by six fold. While the Act identified 47 strategic projects and established new funding lines, progress risks being slowed by fragmented regulatory approaches and a lack of cohesion among member states. The UK’s Critical Minerals Strategy, launched in parallel, also suffers from limited domestic reserves and underdeveloped processing capacity. Without deeper integration of procurement, stock piling, and industrial policy, Western allies will continue to fall short of achieving true supply security.

The convergence of energy and defence demand for these minerals has created new tensions. As defence budgets rise across NATO, the demand for cobalt superalloys, rare earth magnets, and high-performance metals like titanium has accelerated. Yet these materials often come from jurisdictions outside the Western alliance system. A recent IISS report warns that this creates not only commercial bottlenecks but strategic vulnerabilities, especially as Europe steps up rearmament amid US retrenchment.

Meeting the surge in demand will require more mining—at a faster pace and under far greater scrutiny. ESG expectations are rising, exploration risks remain high, and project timelines can span a decade or more. As the World Economic Forum highlights, unlocking new production will require streamlined permitting, more predictable demand-side signals, and innovative financial partnerships. Policy support alone is not enough: investors will demand clarity, and host countries will require capacity and incentives to de-risk long-term operations. It will also require a new approach to financing: Western analysts highlight the difficulty of securing private investment in critical mineral exploration, as China’s dominance in processing and reserves enables it to engage in strategic dumping—flooding the market to suppress prices and deter new entrants, as seen in the lithium, nickel, and cobalt markets between 2022 and 2024.

For companies operating in this environment, due diligence and operational security are no longer optional. Audere Group can provide tailored support through strategic due diligence for new mineral assets, including political and ESG risk assessments, and secure operational advisory for mine sites in complex jurisdictions. Our geopolitical risk monitoring helps clients anticipate supply disruptions, while our stakeholder engagement strategies support firms inbuilding resilient and credible local partnerships.

The new geopolitics of critical minerals is defined by intense competition, resource nationalism, and structural imbalances in processing and refining. Navigating this landscape will require strategic partnerships, diversified sourcing, and a clear-eyed assessment of risk and opportunity.

Keen to Know More?

The Audere Group is an intelligence and risk advisory firm offering integrated solutions to companies in complex situations.

We specialise in mitigating the financial, reputational and physical risks faced by our clients in markets across the world through a 360-degree range of services incorporating security advisory, crisis management and strategic intelligence to inform decision making around transactions, supply chains and disputes.

Contact us to learn how our bespoke risk advisory services can work with your unique circumstances to navigate high-risk environments and changing landscapes through the provision of hard-to-reach intelligence and clear analysis.

Disclaimer: The content of this report is for informational purposes only and does not constitute legal or financial advice. For further details or specific inquiries, please reach out to our team directly.