Tags

Share

Latin America’s Tariff Tango and Security Samba

Welcome to the Audere Atlas, the Audere Group’s fortnightly update on global geopolitical trends, how we engage with them, and what they mean for your organisation.

This week, we assesses how President Trump’s second administration is reshaping US policy towards Latin America and how Beijing, London and others are responding.

The Audere Atlas offers timely, actionable insights that both support key decision-making and highlight areas for further exploration and understanding.

The Bottom Line

Washington’s return to hard-edged geoeconomics is rippling through the Americas, with some governments seeking deeper engagement and others hedging via non-alignment. Meanwhile, China is seeking to capitalise, investing for influence. For business, the upside is real -near-shoring, critical minerals, defence-adjacenttech – so are the hazards: tariff shocks, sanctions spillovers, regulatory churn and bouts of social unrest.

The Brief

With the advent of the second Trump administration, US–Latin America policy is now anchored in transactional bargaining and security outcomes. Since the spring, Washington has paired a reciprocal‑tariff framework with intensified border enforcement. A planned levy on remittances from 2026 and the suspension of de minimis channel for low‑value imports dovetail with moves to narrow asylum pathways, hitting friends like Mexico particularly hard. But policy with foes has also tightened: while narrow and revocable oil‑sector authorisations remain in place for firms operating in Venezuela, designations and enforcement have broadened, raising the risk of secondary exposure for traders, shippers and financiers. Together these measures are intended to reduce irregular migration, rebalance trade and reassert leverage over authoritarian regimes; for firms, they raise operating costs and increase policy volatility.

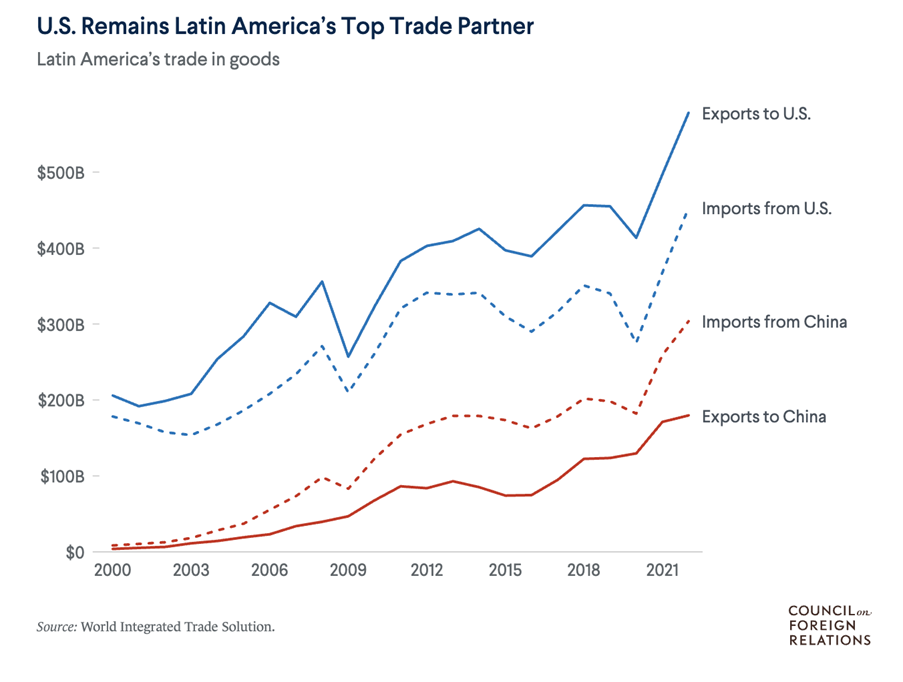

China is moving quickly to capitalise on a more confrontational US posture toward the region. While the US leads, Beijing is now a top trade and finance partner across South America. Beijing has shifted from headline lending to a mix of targeted M&A and offtake‑backed finance plays in infrastructure and the digital ecosystem—from lithium and copper value chains to 5G, cloud and surveillance. The toolkit increasingly includes currency swaps and pilot RMB settlement that blunt exposure to US tariffs and sanctions, alongside a more activist diplomatic track. Expect Beijing to lean into the gaps created by US near‑/friend‑shoring, localising manufacturing in EVs and solar components and offering “non‑interference” terms to governments seeking balance with Washington. The commercial implications are immediate: more PRC‑backed competitors in procurement, tighter entanglement between supply chains and Chinese finance or IP, and growing compliance friction where Chinese tech, data standards and critical infrastructure intersect with US restrictions.

Mexico sits at the focal point of US tariff brinkmanship, migration management and North American supply‑chain integration. Reciprocal tariffs and the end of de minimis increase landed‑cost risk for consumer goods, autos and electronics shipped to the United States. Although USMCA‑qualifying goods remain largely shielded, the six‑year joint review due on 1 July 2026 introduces uncertainty over rules of origin, labour enforcement and dispute mechanisms. Tighter asylum rules, if sustained, will strain border‑state logistics and labour availability in maquila clusters, with knock‑on effects for cross‑border trucking and warehousing. Chinese equipment manufacturers exploring Mexican production are recalibrating as tariff risk rises and as Washington intensifies scrutiny of PRC‑origin components in North American supply chains. For operators, the immediate task is to re‑baseline landed costs, harden origin documentation at the component level and prepare for mode shifts from small‑parcel to freight as compliance burdens bite.

Brazil faces a different mix of opportunity and constraint. Commodity strength and a diversified foreign policy underpin resilience, while Chinese capital continues to flow into power, ports and EV‑related supply chains. At the same time, Washington is increasing pressure on sensitive technology—most visibly in telecoms and energy‑grid equipment—raising vendor‑risk questions for exporters to the United States or firms integrating China‑origin kit into critical infrastructure. Brasília is likely to hedge: maintaining deep links to China while courting US and European finance and technology. This may prove a delicate balancing act and could invite harsh US action, including proxy support for the populist opposition galvanised behind former president Jair Bolsonaro.

While Brazil under President Luiz Inácio Lula da Silva has deepened its engagement with the Russia and China-led BRICS movement, Argentina’s President Javier Milei’s libertarian ideology has brought him close to the MAGA movement. Milei’s ambitious stabilisation effort is opening windows in finance, energy and logistics even as macro volatility persists. Early progress with the IMF has unlocked disbursements and validated parts of the reform path, encouraging copper, lithium and oil investments. The opportunity is real but contingent on steady policy execution and social licence in mining provinces. As inequality rises, the negative side effects of Milei’s idealism may encourage growing opposition to his politics, and by extension, to a Trump-led US.

Elsewhere, Chile and Peru remain pivotal to copper and lithium supply chains, and have both deepened their Pacific trade orientation, working with both China and the West. Chile has modernised its trade architecture with the EU even in the context of global trade rerouting, while Peru’s logistics build‑out, including new Pacific port capacity, is evidence of its confidence of the continued salience of its export economy. As competition for the strategic metals under both countries’ soil intensifies, however, both will face pressure to align more closely to either of the emerging US- and China-led blocs.

Venezuela’s trajectory continues to cast a regional shadow. Narrow OFAC authorisations have kept specific oil projects moving, but counterparties face abrupt licence changes and tightening payment‑routing constraints. Enforcement pressure on criminal networks and human‑rights violators has increased, and the risk of secondary exposure has risen accordingly. These measures intersect with migration dynamics: Venezuelan outflows remain significant, with destabilising spillovers into neighbouring labour markets.

[Image1: Latin American Trade Partnerships: CFR]

So What?

Shifting global trade winds under Trump’s presidency have profound implications for all business operations as they alter the corporate risk playbook. For multinational operators and investors operating in Latin America and beyond, tariff policy has become a board‑level variable rather than a background condition. Firms now have little choice but to maintain live trackers of reciprocal‑tariff settings and model landed‑cost scenarios weekly, rather than quarterly. Contract structures now need to anticipate tariff whiplash by embedding price‑adjustment mechanisms and force‑majeure language that contemplates regulatory shocks.

But the disruption is not over with regard to LATAM. The 2026 USMCA review warrants structured scenario planning around rules of origin, labour enforcement and dispute settlement. Companies with North American footprints should prepare decision trees that link each plausible outcome to concrete actions, from bill‑of‑materials re‑engineering and limited localisation of sensitive subassemblies, to the relocation of final assembly to preserve origin status. Meanwhile immigration enforcement will continue to affect operations through workforce verification, subcontractor risk and cross‑border logistics.

Sanctions and export controls will continue to bite, both via direct Venezuela measures and indirectly through new China‑tech scrutiny. As compliance functions refresh counterparty screening to capture evolving designations and exposure to Venezuela, technology and procurement teams should map PRC‑linked hardware and semiconductor dependencies and draft exit plans.

Amid the uncertainty, portfolio strategy should exploit hedging channels that are opening elsewhere. For instance, the UK’s CPTPP membership and the EU’s revived Latin American trade agenda create alternate lanes for procurement and sales through Mexico, Chile and Peru, particularly in services, pharmaceuticals, machinery and green infrastructure. At the asset level, energy and critical‑minerals projects in Argentina, Chile and Peru remain investable when social licence, water use and community engagement are treated as financial variables, not afterthoughts.

Taken together, the next 12–18 months will reward companies that treat tariffs, sanctions and migration policy as live operating variables rather than background noise.

Audere turn that moving target into decisions your board and plant managers can act on, by mapping tariff and exposure. We keep sanctions and export‑control hygiene current across Venezuela, Cuba and Nicaragua, and we interrogate where PRC‑linked components create latent compliance and operational risk. The same discipline extends to the ground truth: HUMINT‑led political, ESG and labour assessments across Mexico, Brazil, Argentina, Chile and Peru can feed directly into procurement choices, plant siting and stakeholder plans. Where the trade corridor or asset location is high‑friction, we build crisis readiness into the operating model, combining route‑risk analysis, protest monitoring, site hardening and traveller security.

Resilience in Latin America will hinge less on guessing Washington or Beijing’s next move, and more on building portfolios, contracts and logistics that still make sense whichever way they turn.

Keen to Know More?

The Audere Group is an intelligence and risk advisory firm offering integrated solutions to companies in complex situations.

We specialise in mitigating the financial, reputational and physical risks faced by our clients in markets across the world through a 360-degree range of services incorporating security advisory, crisis management and strategic intelligence to inform decision making around transactions, supply chains and disputes.

Contact us to learn how our bespoke risk advisory services can work with your unique circumstances to navigate high-risk environments and changing landscapes through the provision of hard-to-reach intelligence and clear analysis.

Disclaimer: The content of this report is for informational purposes only and does not constitute legal or financial advice. For further details or specific inquiries, please reach out to our team directly.